There is always a cold war between two investing approach. One is qualitative approach and other is quantitative approach. Many fund manager will argue or support any of these investing approach. You may also have a doubt to choose which investing approach. This article may solve these questions.

what is qualitative analysis?

Qualitative analysis is based on non-mathematical concepts. It focuses on things that are difficult to find and measure by mathematical ways. For example, the qualitative approach focuses on question like how the company management make decisions; Is the decision benefit the company; how customers view the company; how company differs from the peers; what gives advantages to run the company in long term; how good the managements are; is company gives important to customers and shareholders and investors.

Qualitative analysis is a subjective concept (where individual give

different opinion based on their intuitions). If you don’t understand the

industry well, then you can’t use the qualitative approach.

Reason why qualitative analysis is difficult:

These are various factors like bias (inclination to something), availability, psychology, misjudgement etc., which will affect the qualitative analysis.

For example, if you are

account holder of yes bank and you like the bank. You should not buy the yes

bank shares because you like it. You should analyse the company from a

different perspective as well. You should not let the personal feeling to

interfere the analysis. This is the just an example and there are many things

that will affect the analysis.

How to do qualitative analysis to find the shares?

You can interview former employee, current employee and customers to do the qualitative analysis. You can also use the management discussion (part of financial reports) and interview of CEO to do this analysis.

But, this information may or may not be

true because it just an answer from their intuition. If you know industry and

psychology better, then you can use qualitative analysis better.

How to use the qualitative analysis in the company:

One of the important uses of qualitative analysis is to find the moat of the company. Moat is characteristic of a company which gives advantage from the peers to maintain or improve their performance in that sector.

For example, Eicher Motors (owns Royal Enfield

bikes) has wider moat Characteristics.

This gives clear advantage to the Eicher Motor to sell their bikes. They have good brand names and good midrange customer. These characteristics separate Eicher Motor from the peer industry. To find the moat of company, you may not able to use quantitative analysis because it’s based on brand name, advantage over other. Therefore, you should use qualitative analysis to find the moat of company.

What is Quantitative analysis?

Quantitative analysis is based on mathematical approach. It uses number and ratio to analyse the company. It involves formula and calculation. One of important question that arise while buying the share of company is ‘what prices should I buy?’.

Quantitative analysis gives an answer for that question by doing certain

calculation like discounted cash flow method, PE valuation methods, price to

book value valuation etc. you can get these data from financial reports

(balance sheets, income statement, cash flow statement). You can also analyse

the performance of the company with these data.

For example, the qualitative approach focuses on question like what percentage the revenue increase over period; What is the operating margin; what is profit our period; Is the company has too many debts; what is current ratio; what is return on equity for past 5 years etc.

By comparing with peer industry, you can decide whether that company looking good or bad. You can’t analyse the ratio without comparing them. If you interpret the data and number right, then you can use the quantitative analysis better.

Knowing accounting improve the quantitative analysis:

Like qualitative analysis, Quantitative analysis has limitation in its own ways. Number and data we collect from balance sheet, income statement, cash flow in quantitative analysis have limitation.

Company can false reports some number in their

financial reports. These reports are prepared by auditors and managers with

their estimates. There are many pitfalls in both accounting techniques and

financial reports. To avoid the pitfalls, you should definitely the study the

basic of accounting or study the limitation of accounting technique in the

financial reports.

One of best example in limitation of accounting technique is depreciation. Company can estimate the depreciation based on their estimation. Mangers may increase/decrease the salvage value or rates to alter the depreciation value of the particular machine. Company like Tata Steel, JSW Steel will have large plants and machine.

So, the depreciation value affects the company’s profit if they represent the

data to their own advantages. Likewise, there are many pitfalls in accounting

technique. Many of the investor analyse the company with the financial reports.

So, any misrepresent in financial reports may cause severe damage in the

investment decisions. This will definitely help you to estimate the company

better. We can analyse the number better if you know accounting.

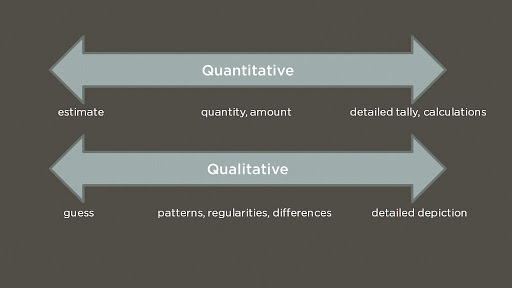

Difference between qualitative analysis and quantitative analysis:

The difference between quantitative and qualitative is like difference between robots and humans. The robots currently cannot analyse or interpret what we feel. But they can perform well in calculation. Human can interpret or analyse the feeling well but not able to calculate as much as robots and computers. Qualitative analysis answers for ‘how the company works’. While quantitative analysis answer for ‘why the company work better’. In these days, financial reports are available easily and media/ newspaper covers all these data. Investors have a lot of information to analyse. To analyse better, you can choose both these analyses to analyse the company.

My advice is that you should use both these analyses to invest in shares of the company or any other securities and you choose percentage (50:50, 75:25, 25:75 etc.) based on your own investing styles. As I listed advantages and disadvantages of both these analyses, you can select the percentage that you want to use.

What percentage do you

choose?

Post a Comment

Post a Comment